Close

Till date of this article there is only limited documents & legislation (or literature thereof) available as official documents and position of the FTA on the subject and further detailed guidance are expected to be published soon. Hence, information in here is based on the same besides drawing inferences from OECD framework as the FTA has indicated that UAE TP Regulations will be largely based on OECD Transfer Pricing

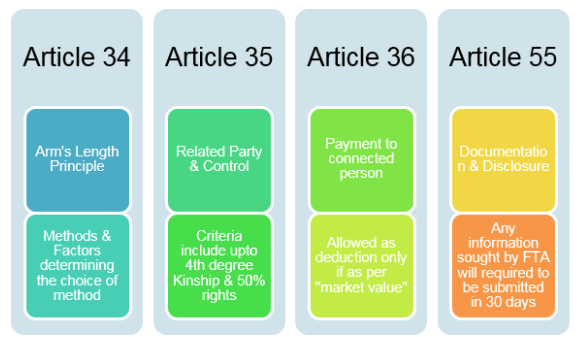

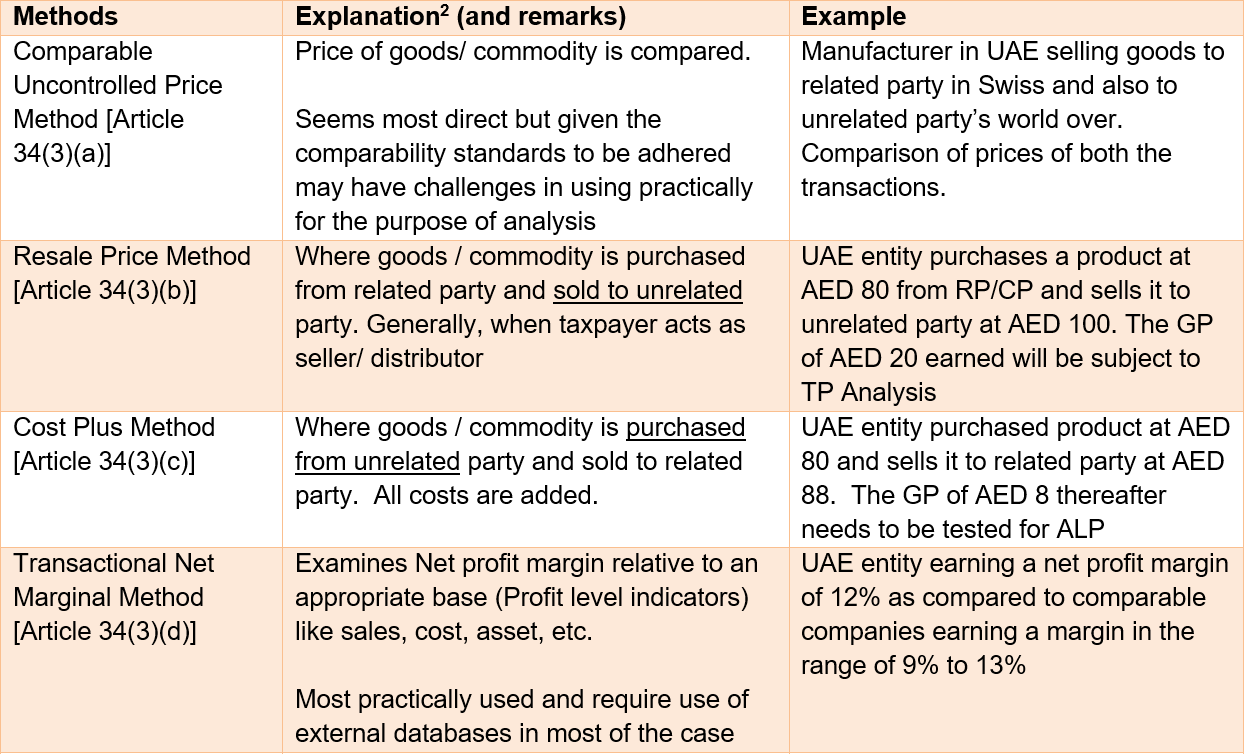

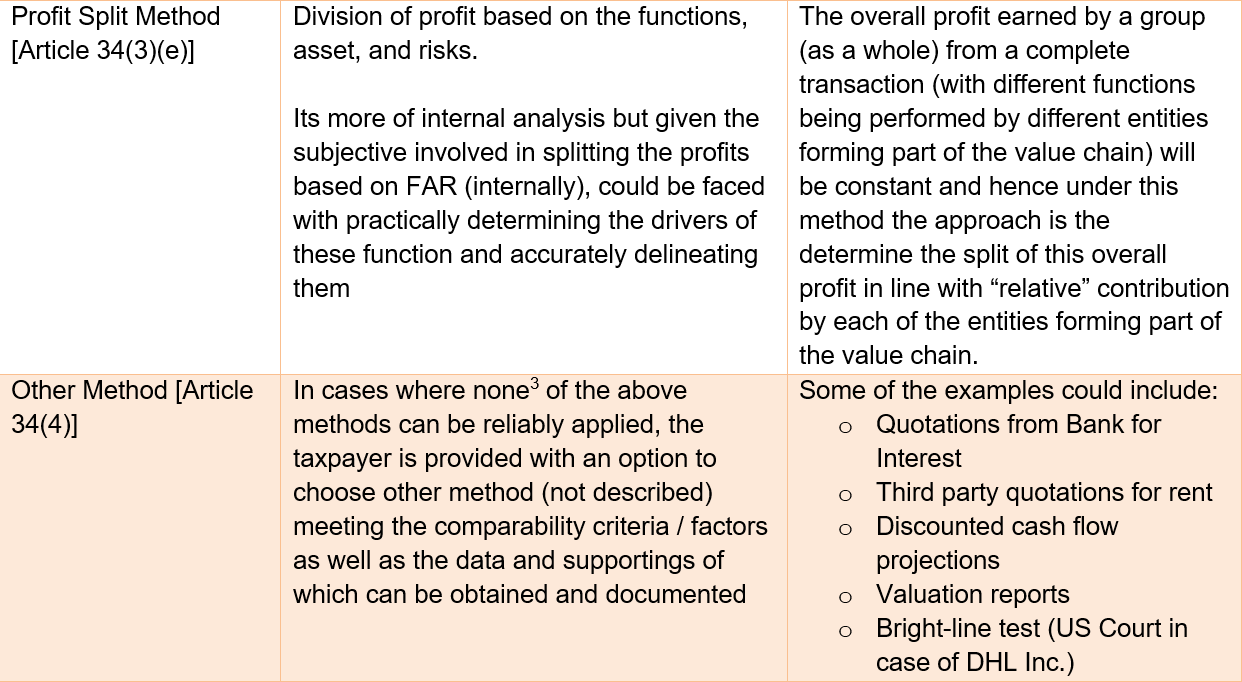

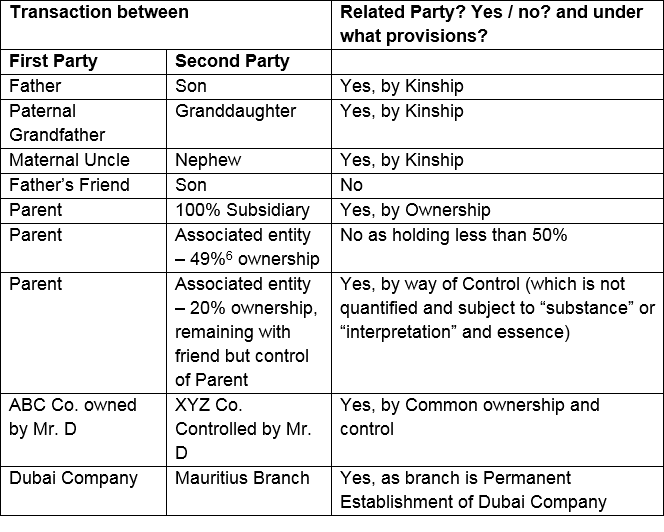

The key TP provisions under the UAE CT Law are discussed in detail in the ensuing paragraphs:

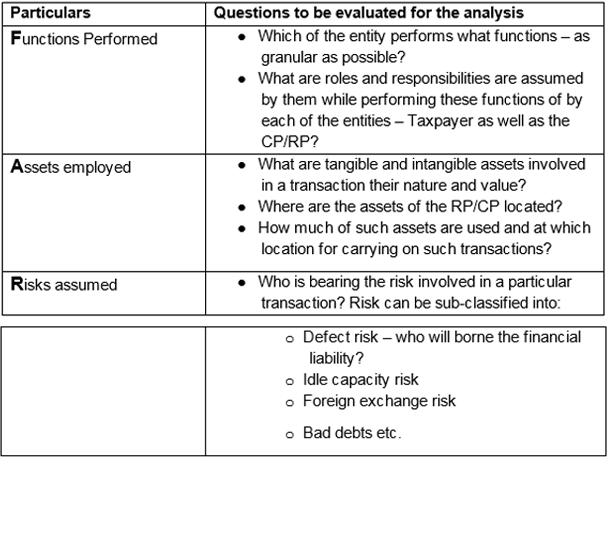

Whilst, other factors assume importance, in this article we have elaborated on FAR analysis as FAR analysis is the heart of determining ALP as it not only tries to help understand where and how the value is created but also helps in identification of which is the tested entity (i.e., simpler entity) and in-turn help in comparability criteria. Refer the brief table below for understanding:

With the e-commerce business prevailing and borderless businesses flourishing there is one more factor that has gained importance in the above analysis, i.e., “Market” whereby significant value of the entire supply chain could be said to be derived. As the consumers of goods or services if belong / reside into a particular jurisdiction, the right to tax the fair share of profit is that of the jurisdiction where these customers are based, and hence global trend is noticing a “FARM” analysis which is an extension of “FAR” analysis.

Connected person has wider definition than related parties mentioned above. A person shall be known as connected person if it is:

As mentioned above, ALP principle must be observed while transacting with RP/CP. In other words, amount paid to “Connected Persons” will be allowed as deduction while computing the taxable income only if the same is found to be in line with “market value” and in case there is any excessive payment, the same is disallowed.

The largest impact of this provision will be felt in case of “Managerial Remuneration” paid to Key Managerial Person (‘KMP’) and Local sponsors . Determining “market value” is not only challenging but also a subjective exercise and hence it would be imperative for the businesses to build up complete / robust documentation around the same. Some of the factors that would be useful to demonstrate their contribution and build up a narrative of ALP:

There are certain exceptions to this principle whereby transactions by the below person with connected person shall be out of purview of connected person:

a. Benefit (derived)

b. Corresponds to market price.

c. Wholly and exclusively for business

d. Not linked / contingent on financial results of the business or paid as part of profit (dividend or the like)

e. Nature of Payment should be either of the following (EG May 2023):

o Provision of services

• Salary

• Wages

• Non-deductible if in the nature of dividend, profit distribution or benefit of similar nature (Article 33 of CT Law)

• Dividend also includes, “…any payment or benefit which in substance or effect constitutes distribution of profits made or provided… or any transactions or arrangements with a Related Party or Connected Person that does not comply with Article 34.”

• The rationale of such a provision is keeping in mind that this payment is not used as a provision to manipulate profits. Since, natural person in their personal capacity will not be subject to tax, hence some check and balance in the system is required. Benefit or otherwise provided by the Connected Person and is incurred wholly and exclusively for the purposes of the Taxable Person’s Business. In other words, a deduction would be denied on any portion in excess of “Market Value”.

f. Guidance as to the maximum allowability / cap on similar nature of payments can be obtained from:

o UAE Federal Law no. (32) of 2021 on Commercial Companies Article 171, Article 104 of this law (not the UAE CT Law referred elsewhere in this chapter)

g. OECD TPG – Para 2.181 (indirect inference can be drawn) – preparation of JD and CV with experience and contribution to the business and operations.

h. Other method – by use of quotations / job offer letter with similar skill sets?

i. HR Consulting firm research / industry report?

j. Glassdoor or similar other online secondary source?

k. Indirect benchmarking by use of TNMM?

There are certain exceptions to this principle whereby transactions by the below person with connected person shall be out of purview of connected person:

Taxable person whose share are traded on recognised stock exchange.Taxable person is subject to regulatory oversight by authority in UAE.

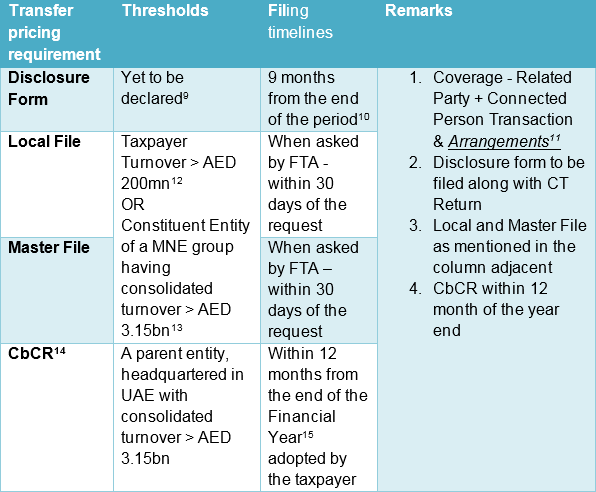

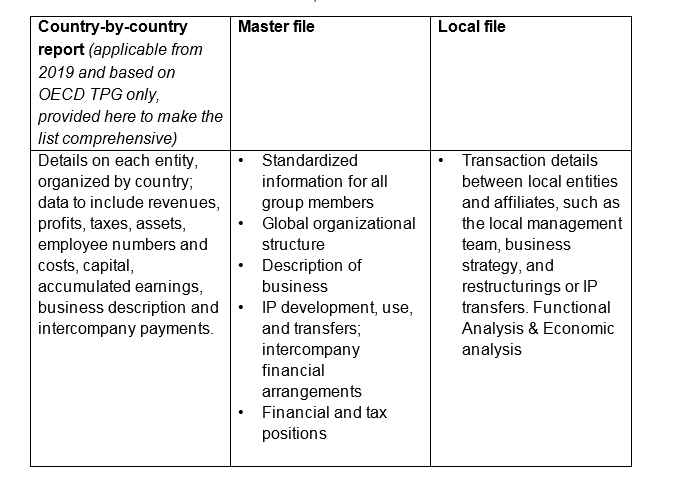

Transfer Pricing Documentation (Disclosure along with Local File & Master File)

Whilst the content (form / format) of Disclosure form is awaited, cue from global jurisdiction can be considered as reference point for the taxpayers to determine the expectations that this could cover:

At the end this Article, we would like to quote, Shri Nanabhoy ‘Nani’ Ardeshir Palkhivala, commonly refer (renowned tax lawyer):

“Tax evasion is reprehensible: it is social injustice by the evader to his fellow citizens. Arbitrary or excessive taxation is equally reprehensible: it is social injustice by the government to the people”.

Considering that UAE is witnessing a new chapter in its evolution and hence preparedness by business is utmost important and time to act is now…!!