Close

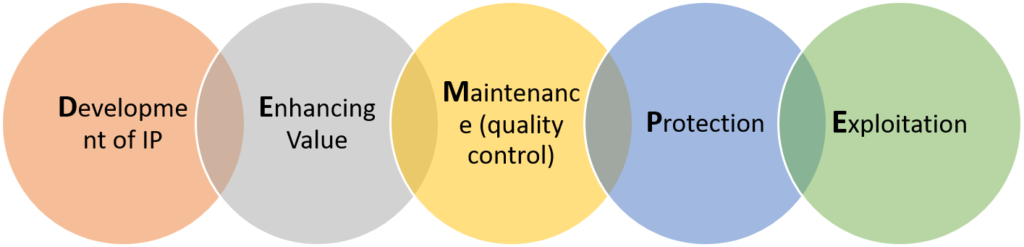

Businesses and companies often come across decision making w.r.t to where should be the IP holding in case of group entities having multi country presence. In the below paragraphs we have analyzed the same from a India stand point especially in light of BEPS and the development thereunder.

Ÿ monitor activities on a regular basis.

a. Foreign holding company gives a better protection to IP (mature law as to the infringement of IP)