Businesses and companies often come across decision making w.r.t to where should be the IP holding in case of group entities having multi country presence. In the below paragraphs we have analyzed the same from a India stand point especially in light of BEPS and the development thereunder.

Key Elements, relevant for IP holding1

- With the BEPS Action Plan (introduction in 2015) the approach towards IP holding underwent a change.

- Action Plan 8-10 of the BEPS Action Plan focuses on alignment of transfer pricing outcome with value creation.

- Gradually the moved away from concept of legal ownership and has adopted an approach of looking at who is contributing to the value-chain for the development and management of intangibles (i.e., a clear focus on ‘substance’ for conducting transfer pricing analysis of Intangibles)

- Recognition of “economic” ownership concept

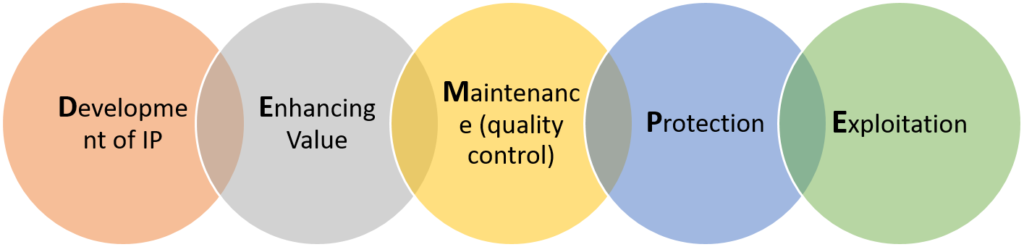

- To determine the entity entitled to the return on intangible, the focus is participation of entity in DEMPE.

- Providing funding for the development activity alone cannot warrant more than a risk-free financial return.

- Return retained by an entity in group depends on the contributions it makes through DEMPE functions to the anticipated value of intangible.

¹It is to be noted that these points are purely from a value and substance point of view being considered as per the governing transfer pricing and related developments proposed under BEPS Action Plan and view adopted by courts in India. The jurisdiction to hold IP and advantages / disadvantages of a particular territory are not part of the analysis, currently. Also, there is no comments on any past transactions or treatment considered in isolation without reference to the current points.