Cryptocurrencies have revolutionized the manner in which people invest their money. They have created a virtual, digital gold rush that’s hard to let go. Indians would not like to be left behind in anything, let alone when it comes to money-making opportunities. But as more power brings more responsibilities, more revolutions bring more regulations.

Bitcoin was the first Cryptocurrency, developed in early 2009. A brain-child of pseudonymous Satoshi Nakamoto, Bitcoin soon rose to fame and awakened a liege of investors. Ethereum, Tether, Dogecoin, and other Cryptocurrencies soon followed Bitcoin. However, the Indian government remained inactive until 2022, when the Finance Act introduced taxation on digital assets for the first time. In this article, we will see the Tax implications of trading in Cryptocurrencies and other virtual digital assets.

What are Virtual Digital Assets?

Virtual Digital Assets (VDA), in simple terms, are digital representations of value that can be stored, transferred, or traded electronically. They can be used for payment, investments, or as a store of value.

Section 2(47A) of the Income Tax Act, 1961 defines Virtual Digital Assets as under –

- Any information/ code/ number/ token which is generated through cryptographic means/ otherwise which provides a digital representation of value that is exchanged with or without consideration. It functions as a store of value/ unit including its use in any financial transaction/ investment; or

- Any digital asset notified by the Government

- A non-fungible token (as notified by the Government)/ any other token of similar nature

In short, VDA includes Cryptocurrencies, NFTs, Digital art, and Digital gold, among others.

What is the taxability of VDAs including Cryptocurrencies in India?

Finance Act 2022 introduced Section 115BBH in the Income Tax Act, 1961 mandating a 30% tax on profits made from trading in VDAs from April 1, 2022 onwards. Surcharge, as applicable, along with a 4% cess shall also be added over and above the 30% tax rate.

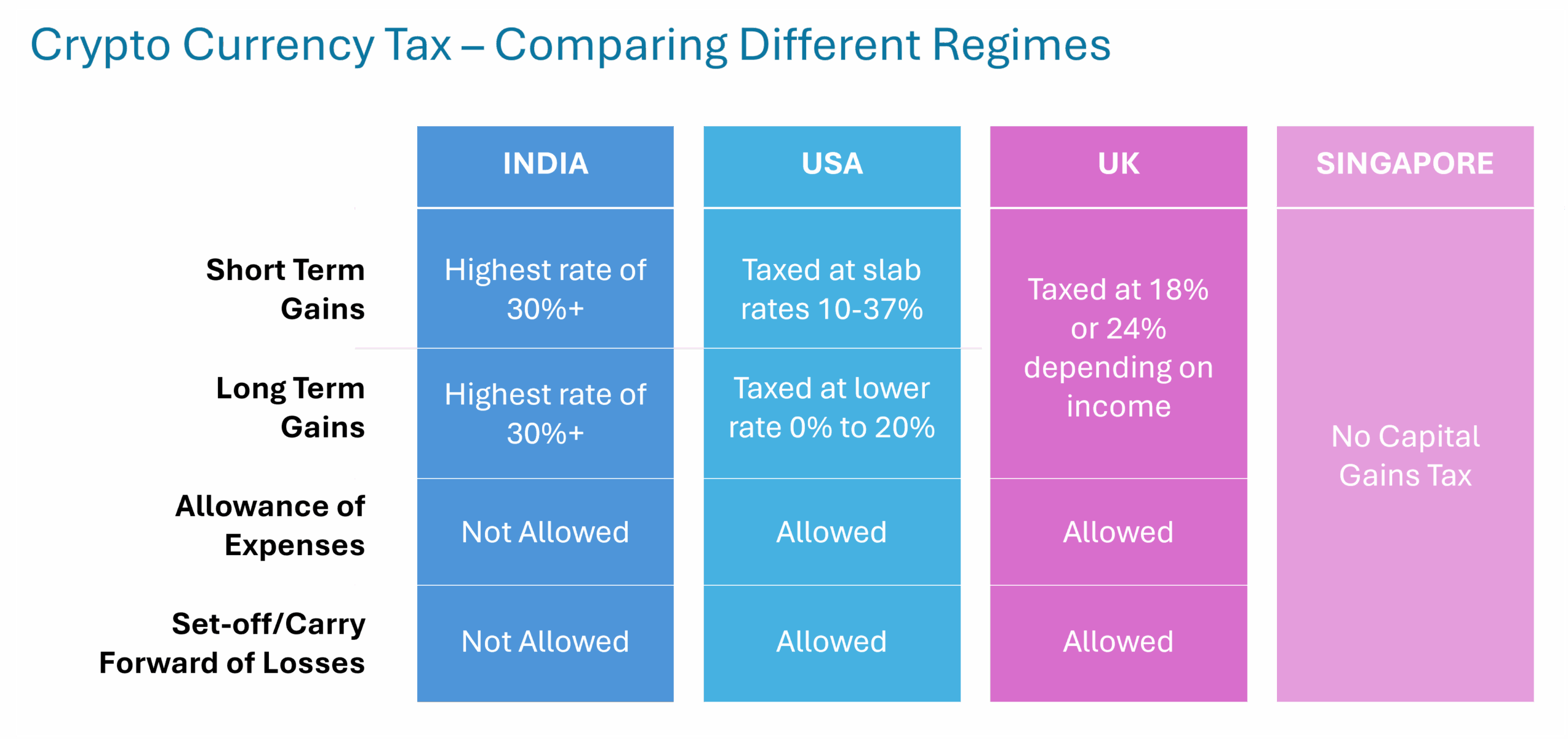

There will be no distinction on short-term or long-term gains and the rate will remain constant whether profits have been made from investments or business activities.

Furthermore, no expenses will be allowed against the revenue, except for cost on acquisition of VDAs.

The Income Tax Return for the financial year 2023-2024 onwards also includes a dedicated section, Schedule Virtual Digital Assets (VDA), for reporting gains from VDAs including Cryptocurrencies.

Which transactions attract Tax on VDAs including Cryptocurrencies in India?

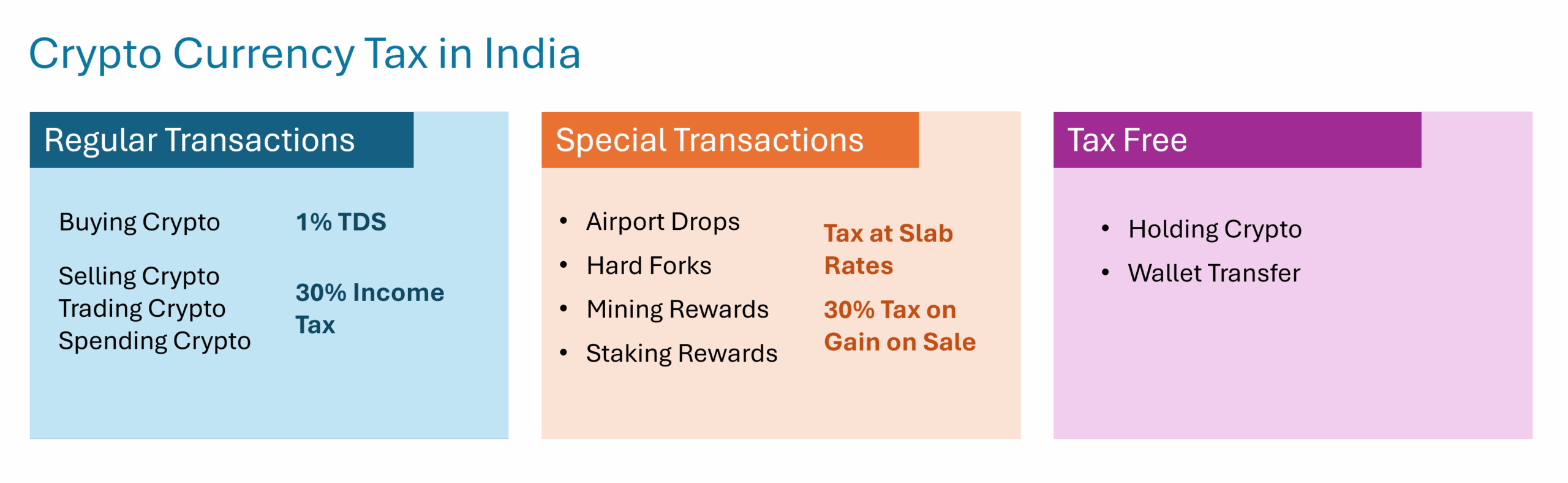

Income Tax is attracted on selling, trading, spending crypto. 30% tax on any gain is charged on sale, trade, or spending of Crypto.

Income Tax is levied at individual slab rate on Airdrops, Hard Forks, or receipt of Gift of crypto. Further a 30% tax is levied on any gains when Crypto received through aforementioned means are sold or traded or spent later.

How to calculate the profit and Tax on VDAs including Cryptocurrencies in Indian environment?

Determine Cost: The amount paid to acquire crypto or the Fair Market Value (FMV) in INR on the day of receipt in any other manner is treated as the cost of acquisition. Transaction fees, commission, brokerage, and other fees are not allowed to be included in the acquisition cost.

FIFO or Average cost method shall be used in case multiple Crypto are acquired at different rates.

Determine Sale Price: The amount received on sale or the FMV in INR in case of trading or spending Crypto is considered as the Sale price. Any additional charges incurred on disposal shall not be reduced from the sale price.

Profits: Sale price – Cost

What is TDS applicability on VDAs including Cryptocurrency transactions?

Since July 1, 2022 1% TDS is applicable on all VDA transactions in India.

When Crypto are traded on Indian exchanges, the exchange deducts TDS and deposits it with the government.

For peer-to-peer trades or trades on international exchange, the buyer shall deduct and deposit TDS.

When one VDA is traded for another, both buyer and seller must deduct and pay 1% TDS.

Individuals and HUFs shall deduct and pay TDS only when the transaction value increases ₹50,000 during a financial year. The limit is reduced to ₹10,000 for all other tax payers.

The deductee shall be eligible to claim credit of the TDS deducted at the time of filing ITR.

How are VDA including Cryptocurrency Gifts Taxed in India?

You might wonder if Cryptocurrencies or other VDAs can be gifted to your friends or relatives. The answer to this is a simple yes. However, it will attract tax. The interesting and liberating part is that VDA gifts will be taxed as any other gift.

Crypto gifts from immediate family members including parents, spouse, siblings, children, and other ascendants or descendants shall be tax free.

Crypto gifts up to ,000 in a financial year from friends or relatives shall also be tax free.

Gifts received on weddings or through inheritance are also exempt from Tax.

Hence, Crypto gifts will be taxed only if the value exceeds ,000 in a financial year at the applicable slab rate on entire value of gift.

Can Investors Set-off/ Carry Forward Losses on Crypto Currency and other VDAs in India?

Loss on Crypto Currency cannot be offset against any other income, including gains on another Crypto Currency or digital assets. Moreover, Crypto currency losses cannot be carried forward to future years either.

In a nutshell, when we look it at the Tax regime on crypto currencies and other digital assets in India, it is quite evident that the government, at least for the time being, is not willing to promote investment or trading in such assets. In comparison, tax regimes of several other countries are quite liberal with regards to digital assets and they are treated similar to any other asset. Indians can only hope that tax regulations on crypto currencies are eased out going forward.