Long-Term Capital Gains (LTCG) tax, a levy imposed on profits realized from the sale of assets held for a specified period (more than 24 months as per the amended provisions), plays a pivotal role in shaping the financial dynamics of small and medium businesses (“SMBs”) and High Net worth Individuals (“HNI”) in India. As these businesses strive to grow and expand, the implications of LTCG tax can be far-reaching, influencing not just their immediate financial health but also their long-term strategic decisions. This article takes a deep dive into the various ways LTCG tax impacts SMBs and HNIs in India and explores the broader implications for the Indian entrepreneurial ecosystem.

Before exploring the impact of LTCG on SMBs and HNIs it is important to understand the specific provisions relating to LTCG which are relevant for SMBs and HNIs.

What constitutes a “Capital Gains Tax”

Capital gains tax is levied on profits or gains arising from the sale or disposal of a “capital asset” during the previous year. This tax is classified under the “Capital Gains” head and is considered income of the previous year in which the transfer occurred, unless the capital gain is exempt under specific sections of the Income tax Act, 1961 (“the Act”) i.e. sections 54, 54B, 54D, 54EC, 54EE, 54F, 54G, 54GA, or 54GB of the Act.

Essential Conditions for being taxed under the head “Capital Gains” are as follows

1. The asset must be eligible to be classified as a capital asset.

2. The asset must have transferred i.e. been sold, exchanged, or disposed of.

3. There must be a gain i.e. positive difference between the sale proceeds and the asset’s adjusted cost base1.

4. The capital gain must not qualify for any of the exemptions mentioned in sections 54, 54B, 54D, 54EC, 54EE, 54F, 54G, 54GA, or 54GB.

Let us analyse all the above conditions in detail below:

I. What constitutes a “Capital Asset”

As per section 2(14) of the Act, “Capital Asset” means:

- property of any kind held by an assessee, whether or not connected with his business or profession.

- any securities held by a Foreign Institutional Investor which has invested in such securities in accordance with the regulations made under the Securities and Exchange Board of India Act,

1992, - any unit linked insurance policy to which exemption under clause (10D) of section 10 does not apply on account of the applicability of the fourth and fifth provisos thereof,]

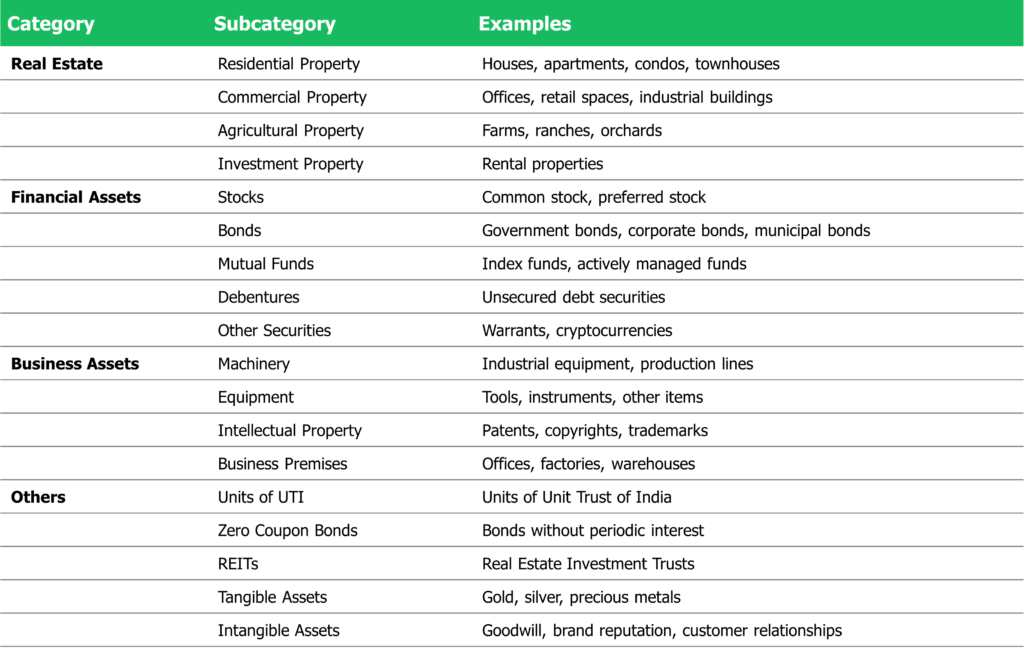

Based on reading of the above definition the following categories of capital assets which can be held by SMBs and HNIs have been identified.

Further, stock in trade, personal effects, art and antiques, agricultural land, are excluded from the list of capital assets.

II. What are the typical capital assets by Indian SMBs and High net worth individuals (“HNIs”)

In the Indian tax framework, an asset is considered a long-term capital asset if it was held for a period exceeding 24 months2 (other than listed securities where the period of holding is retained at 12 months). This definition is crucial for SMBs and HNIs, which often possess a diverse range of assets, each playing a significant role in their operations and growth strategies.

When a small business decides to sell any of these assets after holding them for more than the prescribed period, the profit realized is categorized as long-term capital gains. The applicable tax rate varies depending on the nature of the asset and the income tax bracket of the individual or entity, making it a complex area of taxation that requires careful consideration and planning.

III. Key Impact of the amendments on Indian SMBs and High net worth individuals

Impact of introduction of Section 50AA – Unlisted bonds and debentures

Section 50AA, deems unlisted bonds and debentures as short-term capital asset. For example, Mr. XYZ (HNI) purchases unlisted bonds on January 1, 2023, and sells them on August 1, 2024. Under the old regime, since the bonds were held for more than 12 months, the profit was to be treated as Long-Term Capital Gain (LTCG), taxed at 20% with indexation benefits. With the introduction of Section 50AA, any gain from the sale of these unlisted bonds on or after July 23, 2024, will be treated as Short-Term Capital Gain (STCG), irrespective of how long it was held. This means the profit will be taxed at Mr. XYZ’s applicable income tax slab rate, which would typically be higher than the LTCG rate (i.e. 12.5%).

Impact on HNI

For HNIs, this could mean a tax rate increase to up to 30%. As a result, HNIs may shift their investment strategies away from unlisted bonds and debentures, seeking alternatives with more favourable tax treatment. This shift, coupled with the higher STCG tax rate, will reduce the after-tax returns on these investments, making them less attractive compared to other financial instruments that still benefit from LTCG treatment.

Impact on SMBs

The shift to Short-Term Capital Gains (STCG) tax treatment will make these instruments less attractive to investors, leading to potentially higher interest rates demanded and increased financing costs for SMBs. Additionally, reduced investor interest in these unlisted bonds may result in liquidity challenges for SMBs.

Special Provision for Computation of Capital Gains restricted to only on Market Linked Debentures (MLDs), specified mutual funds excluded

The changes to Section 50AA and the amendments introduced in the July 2024 Budget will have significant implications for HNIs who often invest in a diverse range of financial instruments, including mutual funds, ETFs, and Market Linked Debentures (MLDs). Here’s how the amendments will impact HNIs:

Impact of Original Section 50AA (Finance Bill, 2023):

Taxation at Slab Rates: Initially, Section 50AA classified certain mutual funds with less than 35% equity exposure as Specified Mutual Funds. Gains from these funds were to be taxed at slab rates, which for HNIs can be as high as 30%, instead of the favourable long-term capital gains (LTCG) rates of 20% with indexation or 10% without indexation. This significantly increased the tax burden for HNIs who invested in debt-oriented schemes, international funds, gold ETFs, and balanced/hybrid funds.

Loss of Indexation Benefits: For investments made on or after April 1, 2023, the indexation benefit (which adjusts the purchase price for inflation) was removed. This would have led to higher taxable gains, especially for long-term investments, increasing the tax liabilities for HNIs.

Amendments in July 2024 (Revised Definition of Specified Mutual Funds):

Relief for Non-Debt-Oriented Funds: The July 2024 amendment corrected the broad scope of the original definition of Specified Mutual Funds. Now, only debt-heavy mutual funds (those with more than 65% invested in debt or money market instruments) are included under Section 50AA.

As a result, ETFs, Gold funds, foreign equity funds, and hybrid funds of funds (FoFs) are now excluded from the slab-rate taxation. HNIs who invest in these funds will once again be able to benefit from favourable LTCG tax rates (12.5% without indexation) rather than being taxed at higher slab rates.

Tax Treatment of Debt-Oriented Funds: Debt-Oriented Mutual Funds Still Affected: HNIs who invest in mutual funds that allocate more than 65% to debt or money market instruments will continue to be affected by Section 50AA. Gains from these funds will be taxed at slab rates, which means that HNIs in the highest tax bracket could face a tax rate as high as 30% on short-term capital gains from such funds.

Removal of Indexation: For these debt-heavy funds, the loss of the indexation benefit on investments made after April 1, 2023, means that gains will be taxed at a higher amount, as inflation adjustments will no longer be factored in.

Impact on HNIs

The amendments will likely drive HNIs to reconsider their investment strategies. Given that debt-heavy mutual funds and MLDs will now attract higher taxes, HNIs may shift their focus towards, equity-oriented funds that still enjoy favourable LTCG tax rates. Non-debt funds such as gold ETFs, international funds, and balanced funds, which are now excluded from Section 50AA and will not face slab-rate taxation. HNIs may also explore alternative investment products like real estate or private equity funds, which might offer more favourable tax treatment or greater returns to offset the higher tax burdens on debt-related instruments.

Impact on SMBs

SMBs could face reduced investor demand for equity-focused mutual funds, higher financing costs, and a need to reallocate their investments or seek alternative funding sources due to the changing attractiveness of these funds.

Overhaul in capital tax regime for individuals (HNI) in relation to land and buildings

The Finance Act No. 2024 initially a flat 12.5% tax on long-term capital gains, eliminating the indexation benefit. However, due to concerns about increased tax burdens for properties with modest appreciation, an amendment is being considered. The amendment as per Finance Act No.2 2024 could have a significant impact on High Net Worth Individuals (HNIs) who own properties acquired before July 23, 2024. To be eligible for the said option, the following conditions are applicable :

- Resident Individuals and HUFs: Only resident individuals and Hindu Undivided Families (HUFs) are eligible to benefit from the This means that non-residents, corporations, firms, and other entities are excluded.

- Asset Type: The asset must be land, building, or both. This limits the applicability of the amendment to real estate properties. Other types of assets, such as shares, bonds, or mutual funds, are not covered.

- Acquisition Date: The property must have been acquired before July 23, 2024. This means that properties acquired on or after this date will not be eligible for the indexation benefit under the

- Long-Term Asset Test: The date of transfer, not July 23, 2024, determines if the asset is long-term. This means that if the property was acquired before July 23, 2024, and sold after the required holding period (typically 2 years for immovable property), it will be considered a long-term capital asset eligible for the amendment.

- Sale Timing: The property can be sold at any time in the future. There is no sunset provision, meaning that properties acquired before July 23, 2024, can benefit from the amendment even if sold many years later.

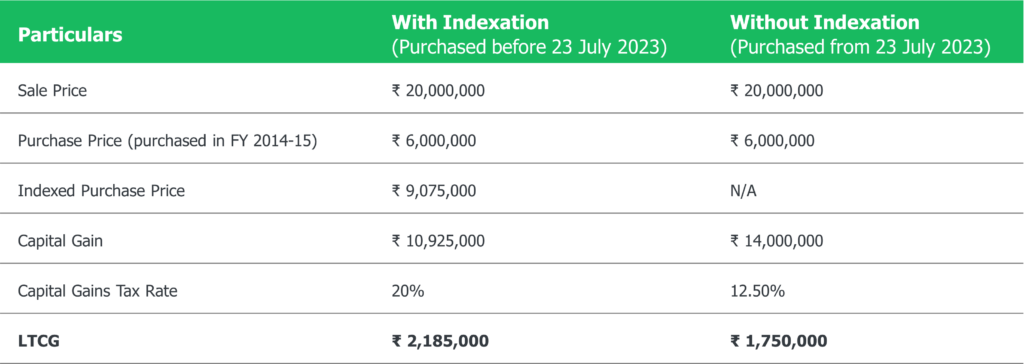

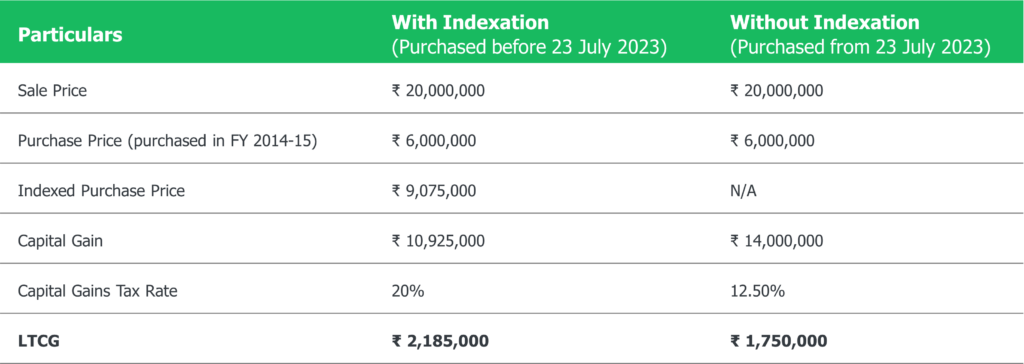

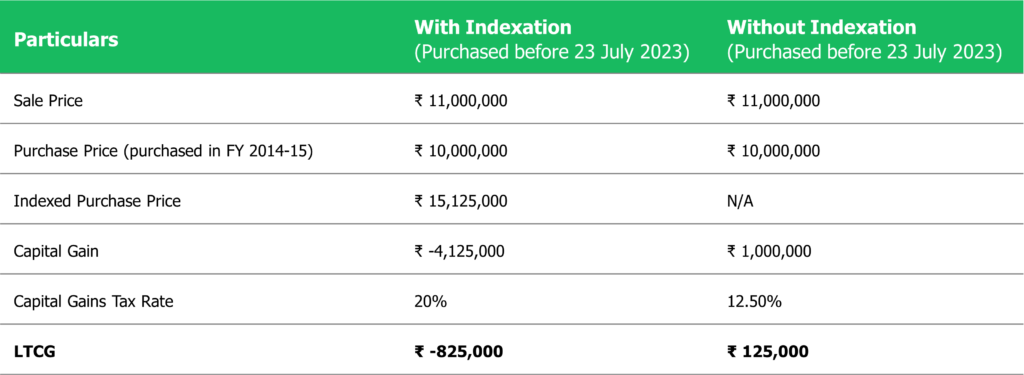

- Tax Computation: Taxpayers can choose the lower of the new regime (12.5% without indexation) or the old regime (20% with indexation). This provides flexibility to taxpayers, allowing them to select the option that results in the lowest tax liability based on their specific circumstances.

- Loss Treatment: If the old regime results in a loss, no tax is payable. However, long-term capital loss cannot be claimed under the old regime. This means that if the sale of the property under the old regime results in a loss, the taxpayer will not have to pay any tax. However, they cannot carry forward this loss to offset against future capital gains.

- Exemptions and Deductions: Exemptions and deductions under Section 54 will be considered in both regimes. This means that taxpayers can still claim exemptions and deductions under Section 54 (for reinvestment in another residential property) regardless of whether they choose the new or old regime.

An example of the above amendment can be understood from the following two scenarios, where the property price has risen significantly and where the property price has not increased significantly in the case of HNI buyer.

A. Where property prices have appreciated significantly

B. Where the property prices have not appreciated significantly

From the above comparative scenarios, it can be observed that where property prices have appreciated significantly, the removal of indexation benefits can result in a higher tax liability compared to the with indexation benefits. This is because the indexed purchase price, which is adjusted for inflation, is lower than the sale price, leading to a higher taxable capital gain. However, when property prices have not appreciated significantly or have depreciated, the removal of indexation can be beneficial, as it may result in a negative capital gain which will not be allowed to be carried forward and set off.

Increase in the exemption limit for under section 112A

The recent budget has introduced changes to the tax rates on capital gains for listed shares. The threshold for tax-exempt LTCG on listed shares has been increased from Rs.100,000 to Rs.1,25,000. This means that only gains exceeding ₹1.25 lakhs in a year will now be subject to LTCG tax, with a higher rate of tax of 12.5% instead of 10% in the case of listed shares where securities transactions tax was paid.

Comparison for LTCG under the current provisions and the amended provisions for listed shares under Section 112A:

* Shares are subject to STT

The changes result in an increase in tax payable by ₹19,375 compared to the current provisions. This increase is due to the higher tax rate (12.5% vs. 10%) and the slightly lower taxable gain due to the increased exemption limit. Despite the higher exemption, the higher tax rate leads to a higher overall tax liability.

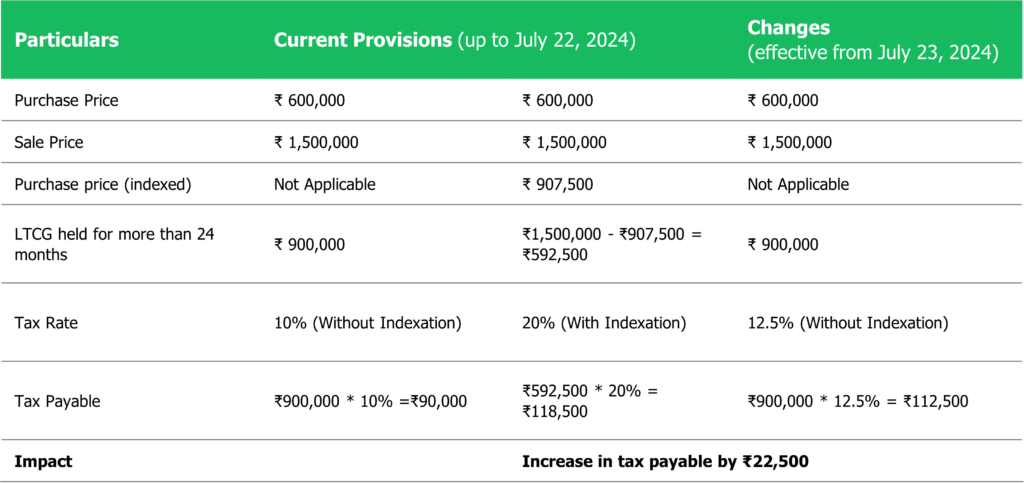

Impact of amendment for unlisted shares under Section 112

The Long-Term Capital Gains (LTCG) tax rate has been decreased from 20% to 12.5%, and the impact of the said amendment can be observed below:

Comparison of LTCG under the current provisions and the amended provisions for unlisted shares under Section 112

From the above example it can be observed that the amendment generally increases tax payable for individuals with long-term capital gains on unlisted shares exceeding the exemption limit.

Conclusion

The imposition of LTCG tax on the sale of long-term assets can have a multifaceted impact on SMBs and HNIs in India. These impacts are not merely limited to financial aspects but also extend to strategic decisions, operational efficiency, and the overall growth trajectory of the business.

Impact on SMBs

LTCG tax can severely impact SMBs by reducing cash flow, which is vital for daily operations, growth, and reinvestment. Increased operational costs due to the tax burden can lead to cutbacks in critical areas like marketing and employee training, weakening their competitiveness. Moreover, the tax can complicate exit strategies by reducing the net proceeds from sales, making it harder to attract buyers or secure favourable prices. It also creates barriers in succession planning for family-owned businesses, potentially leading to dissolution or forced sales. SMBs will face a heavier administrative burden complying with complex tax regulations, diverting resources from core operations. In rural areas, the tax can further strain businesses by reducing funds available for essential investments. Additionally, the fear of incurring LTCG taxes may stifle innovation, as SMBs might hesitate to invest in long-term R&D, reducing their ability to compete.

Impact on High Net-Worth Individuals (HNIs)

For HNIs, LTCG tax also impacts cash flow and operational costs but is often cushioned by diversified portfolios. HNIs might adjust their investment strategies, focusing on shorter-term assets or tax-efficient options to avoid hefty tax liabilities, potentially sacrificing long-term growth.

The information provided in this article is for general informational purposes only and should not be relied upon for any specific business, financial, or legal decisions. While every effort has been made to ensure the accuracy and completeness of the content, we do not assume any responsibility for the outcomes of any actions taken by other parties based on the use or reliance on this article. Any actions or decisions made by third parties using this information are solely at their own risk. We recommend consulting with a qualified professional before making any business, financial, or legal decisions.

- Adjusted for Cost inflation index , commonly known as indexation

- 36 months have been replaced by the amendment introduced by Finance Act No 2024